In this blog, we’ll explore 3 potential best Undervalued Stocks to Invest in 2024. The focus will be on undervalued stocks, as they often present attractive opportunities for long-term investors. We’ll start by showing you how to identify undervalued stocks using a stock screener, and then dive into the top 3 stocks that we have selected from the filtered results.

Finding Undervalued Stocks to Invest in 2024

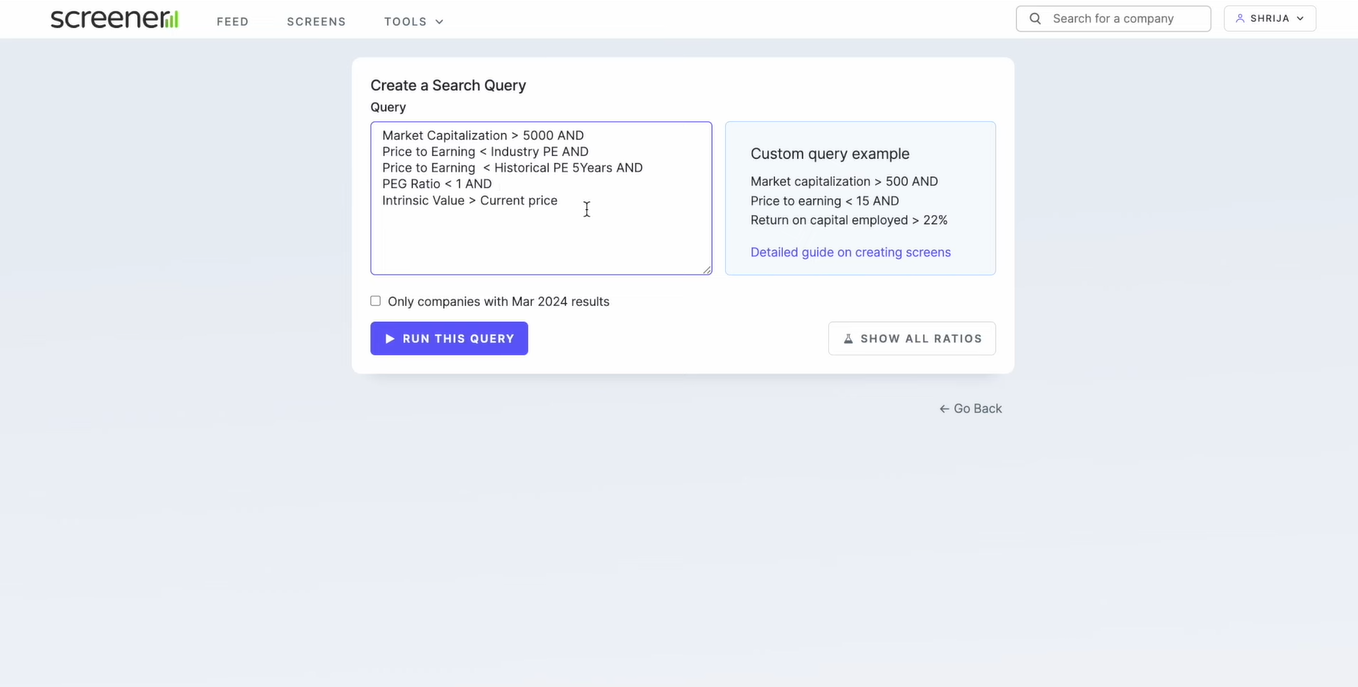

To find undervalued stocks, we will be using a stock screener with a market capitalization over 5,000 to filter out very small companies. we will look for stocks having a price-to-earnings (P/E) ratio less than the industry average, as sometimes different companies in the same industry may have different models, products, and valuations. Comparing the P/E of a company to its own historical 5-year median P/E can give a clear picture of the company’s valuation.

In addition to a low P/E, we’ll also consider the PEG ratio (price-to-earnings-to-growth ratio) being less than 1. Even when the P/E is a little high, if the PEG ratio is less than 1, we may still consider the company. We are also adding the intrinsic value greater than the current price as a parameter.

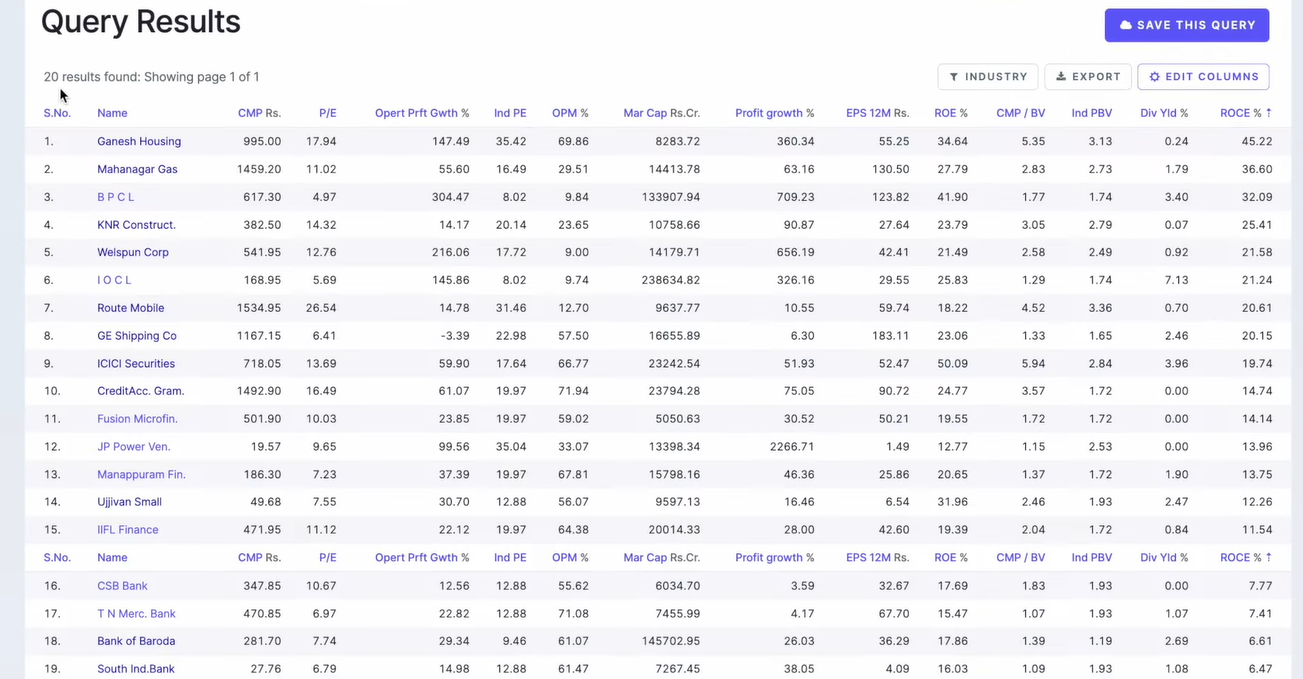

After applying these strict filters, We have identified 20 undervalued stocks. While many of them are quite good.

-

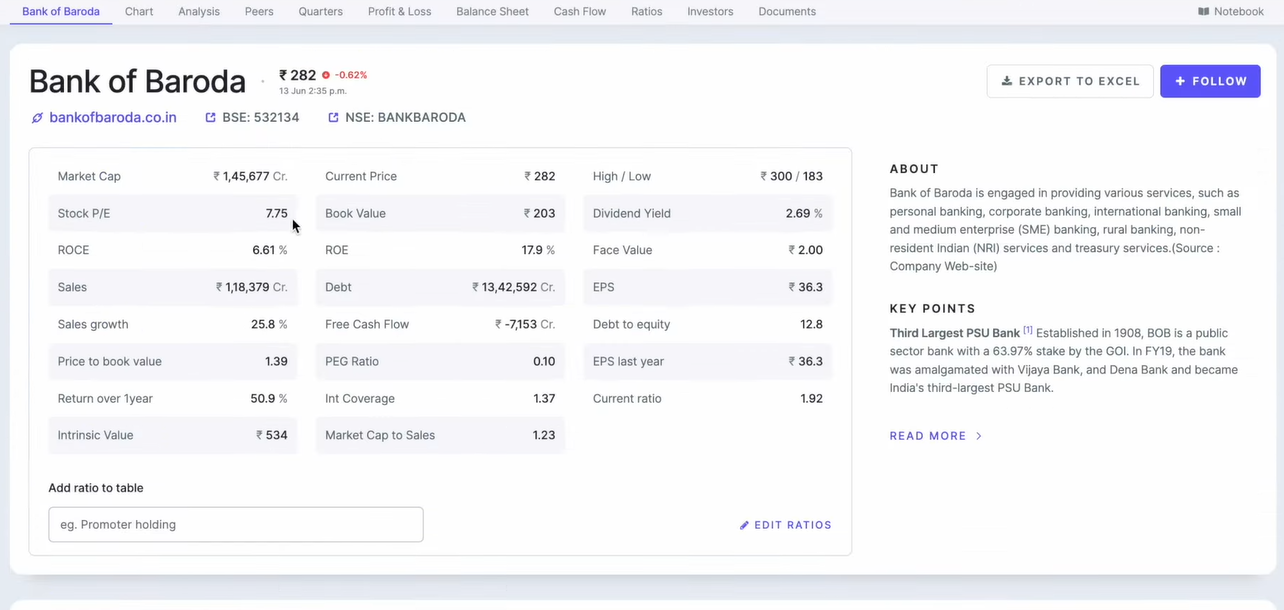

Undervalued Stocks to Invest in 2024 – No.1: Bank of Baroda

The first stock We’ll discuss is Bank of Baroda, which is a public sector undertaking (PSU) bank. With the Bharatiya Janata Party (BJP) back in power, we can still see a rally in some specific PSU stocks.

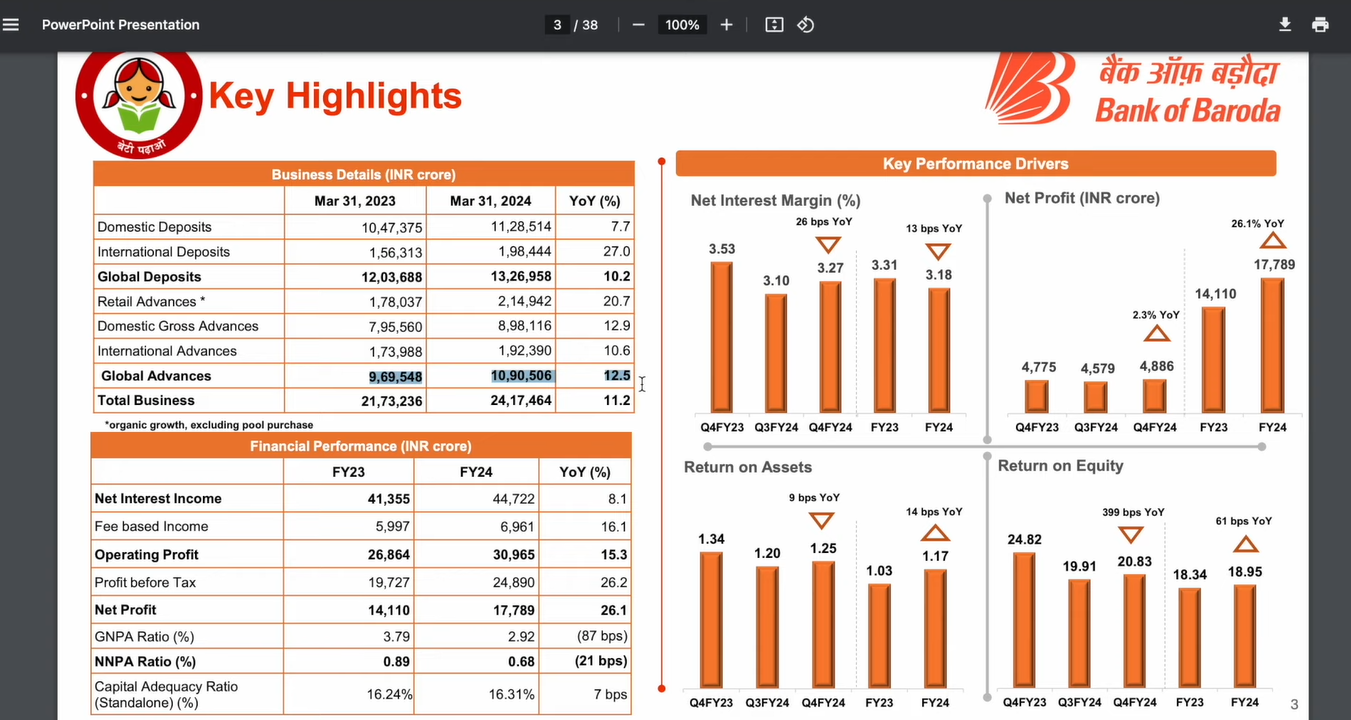

Looking at the financials of Bank of Baroda, we can see that its P/E is only 7, and it’s well below its historical 5-year median P/E. Its intrinsic value is also higher than its current price level. The key reason for its good results is that after the election results, we can see a 12% year-on-year increase in global advances, an 8% increase in net interest income, a 26% increase in net profit, and a significant reduction in gross NPA and net NPA. Both FIIs and DIIs have been buying this stock in the last quarter.

-

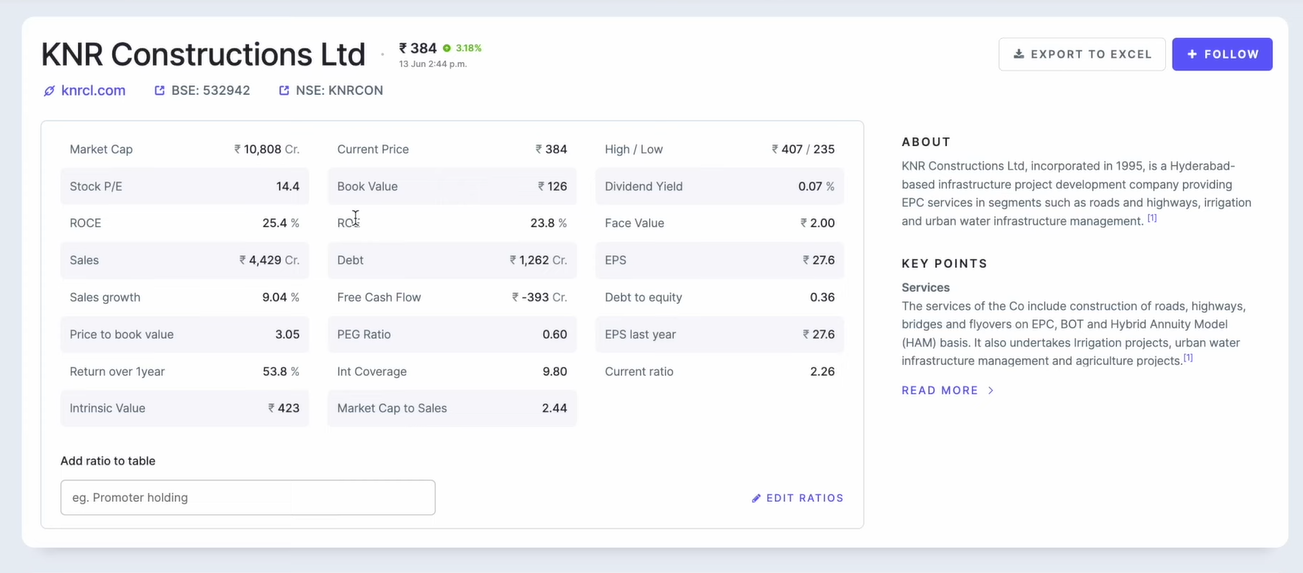

Undervalued Stocks to Invest in 2024 – No.2: KNR Construction

The second stock that we are going to talk about from these undervalued stocks is KNR Construction. This stock is based on the Andhra theme and the Chandrababu Naidu theme, because of which, after the election results, we saw a run-up of about 30% in this stock. In fact, today, this stock is also currently up by over 3%. It’s a Hyderabad-based infrastructure company that provides EPA services in roads, railways, irrigation, etc.

It’s intrinsic value is higher than its current price level. It has a great ROE of 25, ROA of 23, and debt-to-equity less than 1 in the last five years. The revenue has doubled, and net profit has also multiplied in the last five years. They have an operating profit margin of 24%, which is great, and we can see a healthy growth in EPS. We can also see their reserves are growing, and DIIs can be seen buying this stock in the last quarter. The total order book position as on 31st March is 5,300 crores, and they are targeting order inflow of 2 to 3,000 crores for the next quarters. So, this stock is an undervalued stock along with good growth perspective, making this stock very attractive.

Let’s have a look at the technicals on the monthly chart. We can see a multi-year breakout, so after almost three years, we can see a breakout with very high volume, which is a good sign. But it has already given a very good run-up. For a short-term perspective, currently, it is looking a bit stretched, and a pullback towards the 20-day EMA would be a better option in our opinion.

-

Undervalued Stocks to Invest in 2024 – No.3: Ganesh Housing

Finally, let’s talk about stock number three, which is a potential multibagger stock in our opinion (not a recommendation at all) and we are adding this stock to our long-term portfolio. The stock we are talking about is Ganesh Housing. This company specializes in the residential sector and mostly caters to the mid and higher-income segments of the market. It has a strong presence in and around the city of Ahmedabad. As per their call, the price growth in the residential sector in Ahmedabad is around 9% year-on-year. In fact, we feel the GIFT City development in Ahmedabad can actually boost the outlook of the Ganesh Housing stock.

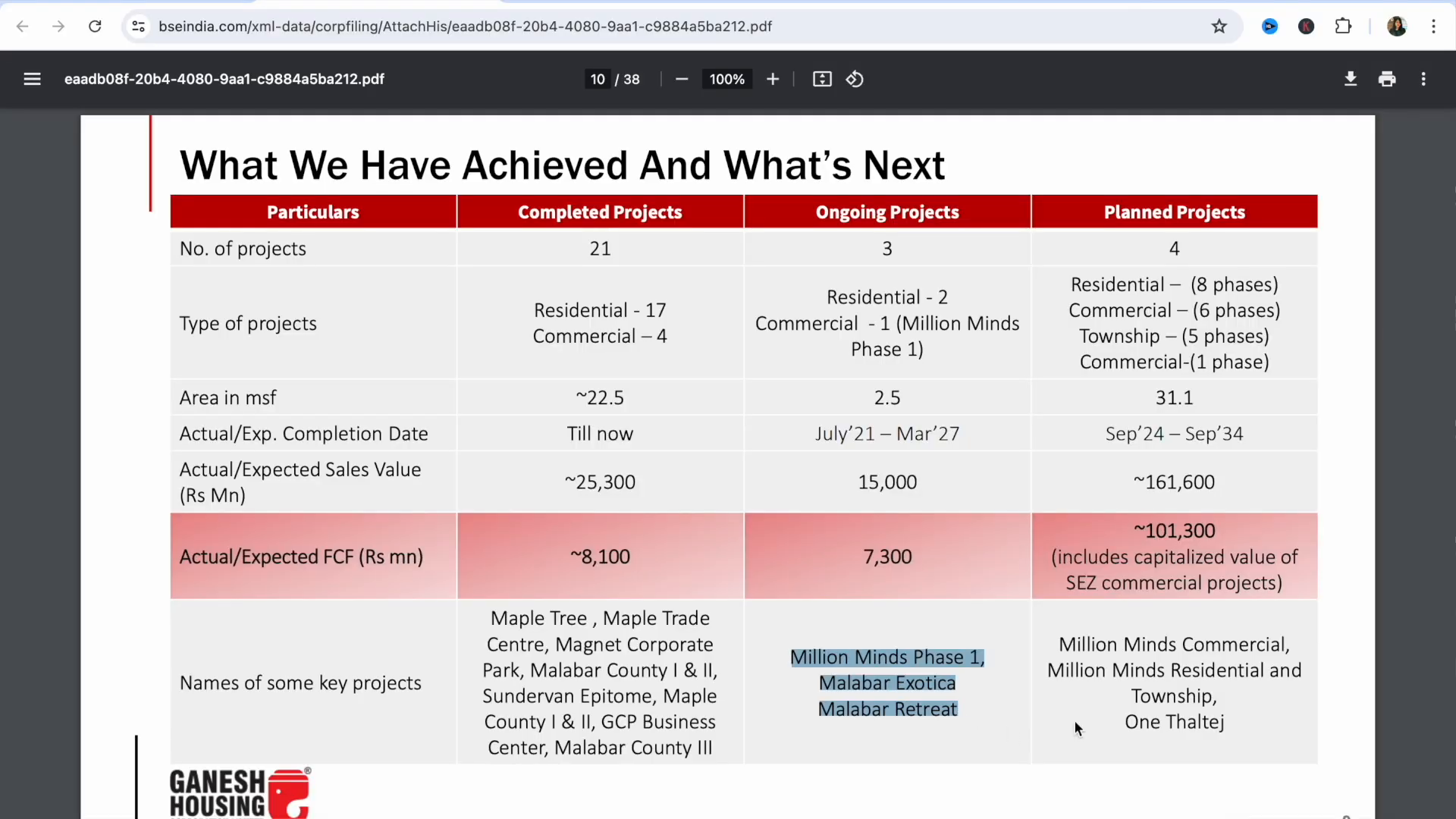

They have two ongoing projects, and for new planned projects, you can see on the screen. They have been focusing on the completion of projects ahead of time, which we particularly like. If you talk about the financials, the revenue grew 53% year-on-year, a PAT of 45%, and an EPS of 186, which is very good as we had mentioned before. Its intrinsic value is also higher than its current price level. The ROE is 45, the debt-to-equity is almost zero in the last five years, the revenue has grown about 3.5x, and the net profit has grown about 177x. They are constantly increasing their reserves, increasing their operating cash flow, and FIIs can be seen buying this stock in the last quarter. So, the financials are looking amazing, and currently, it is among the high-growth stocks.

Let’s have a look at the technicals as well. After January 2008, it has given a 16-year breakout with very good volume in March 2024, and since then, it has already given us a run-up of about 80%. So, after this multi-year breakout, we saw that the stock was showing some consolidation, but again, on 7th June, we can see a breakout from this consolidation with good volume. So, we are adding some positions in this stock in our stock portfolio. This we are telling only for disclosure, but it is not a buy-sell recommendation. we can also go wrong, so please do your own research.

Call +91-7899393441 or Click here to join our Stock Market Course

Disclaimer : We are NOT a SEBI registered advisor or a financial adviser. Any of our investment or trades we share on our blogs are provided for educational purposes only and do not constitute specific financial, trading or investment advice. This blog is intended to provide educational information only and does not attempt to give you advice that relates to your specific circumstances. You should discuss your specific requirements and situation with a qualified financial adviser. We do share details and numbers available in the public domain for any company or on the websites of NSE and BSE.