6 Fastest Growing Stocks to Buy Now

The stock market is currently at an all-time high, but there are still some excellent stocks available at good buying levels. As the market reaches new highs, we need to be cautious, especially with stocks that have already run up significantly and have high valuations. It’s important to book profits on these stocks before the operators take big profits, causing them to correct 30-40% or more. In this blog we will provide you 6 fastest growing stocks to buy now that can give you good returns.

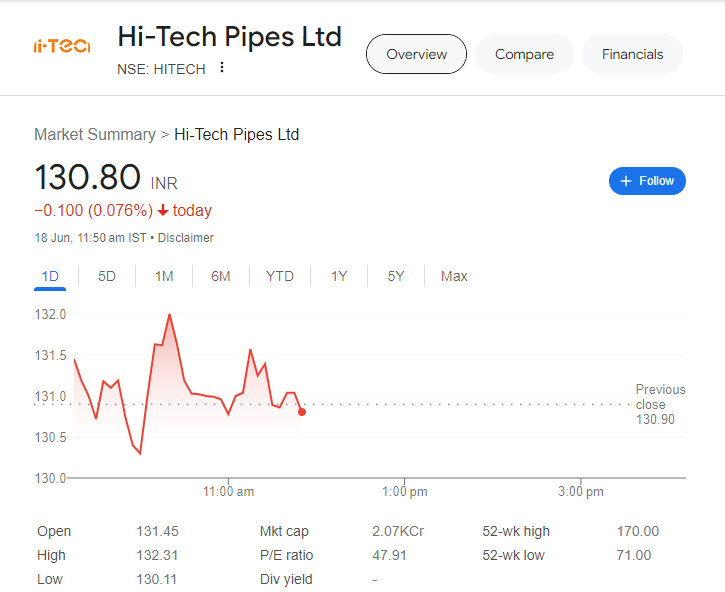

1) hi-tech Pipes Limited:

Hi-tech Pipes Limited is one of India’s leading steel pipe manufacturers, with a presence in over 5,000 retail stores. The company produces a range of products including steel round pipes, sections pipes, coils, and various other products. With a market cap of ₹2007 crore, this is a relatively small company. If the company’s management performs well in the coming years and the company sees solid growth in profits, this stock could provide excellent returns. The stock listed on the NSE in February 2016 and has delivered impressive returns of 220% since then. Hi-tech Pipes Limited could be one of the 6 fastest growing stocks to buy now.

2) Syrma SGS Technology limited:

Syrma SGS Technology Limited is an engineering and design company that offers electronics manufacturing services, such as printed circuit board assemblies, radio frequency identification products, motherboards, memory cards, and more. The company’s products cater to the automotive, healthcare, consumer, IT, railways, and various other sectors. With an order book of over ₹3,000 crore, this is a good opportunity to invest in this stock. The stock is currently available at attractive levels of around ₹472.40, making it one of the 6 fastest growing stocks to buy now.

3) KPIT Technologies Limited:

KPIT Technologies Limited is a top-quality company with excellent business growth. The company provides a wide range of electronics manufacturing services, including printed circuit board assemblies, radio frequency identification products, motherboards, memory cards, and more. These products are utilized across various sectors such as automotive, healthcare, consumer, IT, railways, and others. The company has an order book of over ₹3,000 crore, which is a positive indicator. The stock is currently available at attractive levels around ₹1507, which is a 31% correction from its 52-week high. KPIT Technologies Limited is considered one of the 6 fastest growing stocks to buy now.

4) Avanti Feeds Limited:

Avanti Feeds Limited is one of the fastest growing stocks to buy now, being one of the largest Indian offset partners for LTI Systems Limited and Israel Aerospace Industries Limited, manufacturing electronic subsystems, cable, and wire harnesses. The stock saw a good rally of 13% on 14th February and has continued its upward momentum, gaining 21% in the last 5 trading days. The stock is currently trading near its 52-week high, and there is good buying seen in the counter. This stock has the potential to make a new high soon, so investors can consider taking a limited exposure at current levels, while those who already hold the stock should continue to hold it as it is expected to generate excellent returns in the coming years.

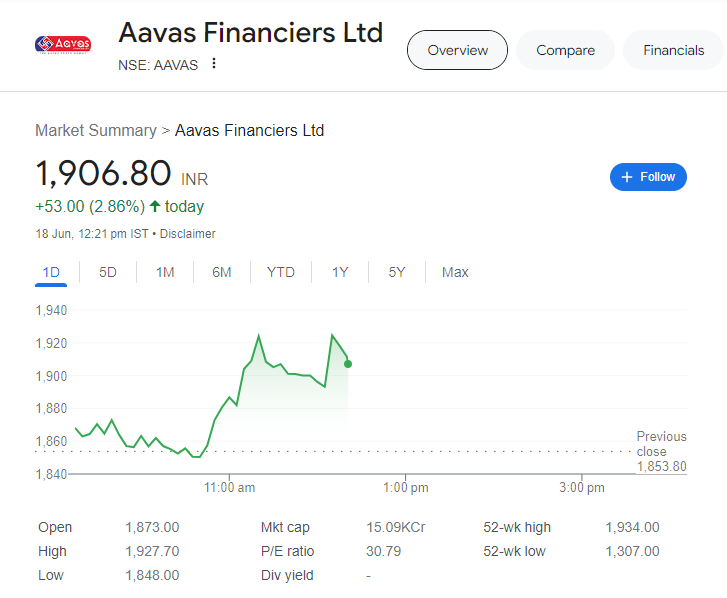

5) Aavas Financiers Limited:

“Aavas Financiers Limited is an excellent company that provides housing loan services. The company’s sales have been quite good, but the decline in operating profit margins has led to a decline in profits. However, the positive aspect is that both FIIs and DIIs have increased their holdings in the company, while the promoters have trimmed their stake. Investors who already hold the stock should continue to hold it, as this stock is expected to generate excellent returns in the coming years, especially given its potential as one of the 6 fastest growing stocks to buy now.”

6) DCM Shriram Limited:

DCM Shriram Limited is a diversified conglomerate with a strong presence in the chemicals, fertilizers, and sugar businesses. The company has seen excellent growth in its sales, but the decline in operating profit margins due to inflation has impacted its profitability. However, the company’s fundamentals remain strong, and both FIIs and DIIs have increased their holdings in the stock, while the promoters have trimmed their stake. Investors who already hold the stock should continue to hold it, as this stock is expected to generate excellent returns in the coming years, especially considering its potential as one of the 6 fastest growing stocks to buy now.

Conclusion:

In the current market environment, it’s important to focus on stocks with solid business fundamentals and growth potential. While some stocks may have already run up significantly, there are still opportunities to find undervalued gems that can provide excellent returns in the long run. By carefully analyzing the companies, their financials, and the market trends, investors can identify the fastest-growing stocks and potentially unlock multibagger returns. Remember, patience and a long-term perspective are key when investing in the stock market.

Call +91-7899393441 or Click here to join our Stock Market Course

Disclaimer : We are NOT a SEBI registered advisor or a financial adviser. Any of our investment or trades we share on our blogs are provided for educational purposes only and do not constitute specific financial, trading or investment advice. This blog is intended to provide educational information only and does not attempt to give you advice that relates to your specific circumstances. You should discuss your specific requirements and situation with a qualified financial adviser. We do share details and numbers available in the public domain for any company or on the websites of NSE and BSE.